Short Introduction to my First

Post of 2013!

Well it’s been quite a while

since I have written anything for this old blog of mine. That’s not because

there has not been much going on quite the reverse, too much has been going

on. Way too much which means that I

should get down to the task and write about it.

Well since this is my first entry

for 2013 and it’s almost over, I may as well start with something simple and

easy. And that is some recent trades of mine.

I managed to gather a small grub

stake (Funds for trading) to trade. £5,000 to be exact. When trading, it’s important to start with a

decent grub stake. For example last year I

managed to scrape together a grub stake of £2,000. After buying the charting and squawk box I

was left with just £1,700 to trade. This allowed me to trade around £5.00 -

£10.00 a tick. In the first week I was up about 30%, but the

next week after trading from morning to market close I was flat. All that work

for nothing. I traded around 10 trades (round trips) per day. There were two frustrations, the first I was desperately

trying to earn a living off it. The second was that I wanted to grow the account

at the same time, and finally I was practicing my short side of trading.

Because my grub stake was so small it meant that I was taking more risk to

generate say £100 -£150 per day. By the third week I blow up, this was after a number of lost opportunities

to go short and hesitating while in the trade then cutting the small profits.

Then I realised that if that the amount

I money required to live of meant I was taking too much risk on to generate it,

after all 10 – 15% per day is fairly risky.

In addition making withdrawals meant my account was never growing and

was vulnerable to a large draw down.

I decided to be reckless and

short over an event. Placing a large stop, with my children screaming at my

heels about some minor issue the stress levels were just too much for me. I

retired into the bedroom and went to sleep. The announcement came and my stop

got hit, I started to chase my loses

which of course lead to more losses.

I did take profits when they came

and so when I blew up my account I lost a total of £900.00.

Often times when a trader blows

up their account it doesn’t have to mean they have a lost all their money only

the money that was in the account. Obviously any withdrawals have been taken

away from market risk. Still when your

adequately funded it helps to reduce the likely hood of blowing up due to

taking risk simply to make a living. What am I talking about. Well you need to

be able to earn a living and be able to add to your account to absorb the

down days. So if you can live on £300 a day and you have say £200 to cover your

down days then another £200.00 to grow our account your going to need to make

£1,000 if that represents 10% of our account size that’s risky. If only 5% then

that’s not too bad (£20,000).

So that was way lost year 2012!

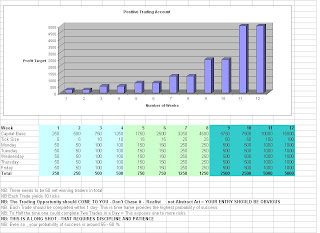

This year, I managed to get a small

grub stake I was trading mini lot’s of 1/10 of a lot. Started trading up to 2 lot equivalent and

managed to generate £1,400 of P&L by

the end of the week, that’s after two losing days. However

the broker Prospreads decided that the mini lots were simply an introduction to

using the trading platform and reduced my maximum size to 1 lot. They announced

this change during the trading day when my account was in loss. It restricted

my tools to double up ( Martindale technique).

For the next two weeks I was up

and down on my account. One day up £600 next down £950 then up £440. I suffer

from a chronic inclination to trade whether I am up or down. Often times the broker

will send me a message reminding me that the market closes at 21:00 hours! I just love to be in the trade.

Basic approach has been to jump

into the water, with a view to reach a certain destination and see how the tide

is. If it’s too strong to go in the direction I wish I simply go with the tides

direction. Obviously this has pluses and minuses. On the minus side jumping in

means that you may get caught by a strong tide in the wrong direction, by the

time you realise where it’s going your down on the P&L by around £-500 I

have been in positions that have been of side £600+ and by the time I have

found the trend and traded it it’s meant I have had to hold on to a winning

position for £800 to be £200 up on the day.

But the rewards are if you are going in the right direction you get to

keep all the £800.00.

For example the Thursdays

Interest rate Announcement trading day:

The next day was Non Farm

Payrolls

Having had a decent trading

result the previous day, I decided to be cautious on Non Farm Payrolls,

therefore was only going to go in with a

1 lot at 9040 ( first Arrow) , with the pivot point of 9074 as my exit. Overall

on the daily chart it looks all bearish but for both the S&P and the DAX

both main pivot points had not been breached. Technically a high probability trade

worth around £708 . I figured the pivot would be hit prior to the NFP

announcement, why I have no idea?

Well as soon as I entered the

price declined down to around the 9030’s level. I then realised that I was the

last fool to have brought at 40, it never reached passed that level for the

next four to five hours! Since it was languishing around the lower 30’s I

decided to be “smart” and add an additional lot. By the time it was 13:20 hours

10 minutes prior to the NFP announcement I realised I was on my own the

expected figure was 125,000 jobs, consensus and the media were very bearish on

it. I had a deep stop at 9010.

The figure was 204.000 a surprise

so expect the bullish move. First I saw the Bund drop like a stone, I realised

that I was going to be stopped out, but since it was such a bullish

announcement any price movement was likely to rise up from any pull back.

At that moment 20 seconds after

the announcement my trading platform (i.e my Broker’s platform) crashed and my

stop was hit (Second Arrow) . By the time I had restarted the computer and log

onto my brokers platform my P&L was -£1345.00 I jumped in at 9009, the

price having crawled back up from it’s low of 8988! I tried to get in early

with my conviction that the price will hit the pivot point above even though I

am overall bearish on the market, having seen the spike the day before representing

the DAX’s all time highs.

The broker said that as my

account was now a mere £3400.00 I did not have enough equity for margin to

trade with a 2 lot! I remained in with my little one lot until my equity rose

then I banged in with that extra 1 lot. By

the end of the hour candle it was showing a rock solid hammer. My conviction was complete, I placed my trailing

stop at 8990 and waited it out. I was

holding on as my trade accumulated in profit, showing £1700+ at one state and I

was in profit of around £400. The S&P looked like it was on its way to its

pivot point of 1758. One takes notice of the EuroStoxx in the morning and the

S&P by the US Open at 14:30 hours GMT. The price retraced from it’s strong upward

move ( to take some breath) my £400 profit now went into a loss of around -

£660, I continued to hold, and was aggressive in raising my limit order from

the original 9074 to 9085.

Finally, as the price neared the

pivot of 9074 I held my nerve and watched it broke through. I then had second thoughts but being greedy,

I once more reminded myself: “Always leave some for the other guy”. I closed my position at 9077 with a profit of

£1168.00 (Third Arrow) not bad

considering my original profit goal was £700.00.

It’s not often one trades the Non

Farm Payroll to be on the wrong side of it and still come back with a profit. I

was happy with my trading that day. I believe the broker tried to pull a fast

one. But for me the lesson was first don’t always come in guns a blazing in

full size. Stops play a good role to give clear heads, and limiting losses,

certainly in times of when a broker tries their shenanigans’. The focus should

first and last be about the trade idea and it’s relationship with the market in

play not simply about the money.